Many patients living with leg pain or unsightly bulging veins hesitate to seek help because of financial concerns. You might look at your legs and wonder if the solution is within your budget. One of the most common questions patients ask is: does insurance cover varicose veins? The answer is generally yes, but it depends heavily on the specific nature of your condition and the terms of your policy. Insurance providers typically distinguish between cosmetic concerns and functional health issues.

Most major health insurance plans recognize that vein disease is a legitimate medical condition, not just about how your legs look in shorts. When a varicose vein causes pain, swelling, or skin changes, it moves from a cosmetic annoyance to a medical necessity. Coverage is available for the majority of patients who demonstrate that their symptoms affect their daily quality of life.

You do not have to live with the discomfort or the appearance of bulging veins. When looking for vein treatment in Windsor, CT, understanding the specific criteria your insurance company uses will help you access the care you need. This guide breaks down the requirements, the diagnostic process, and which specific procedures typically qualify for coverage.

Defining Medical Necessity for Vein Care

Insurance companies are businesses that need proof before they pay for a procedure. They want to verify that a varicose vein presents a health risk rather than a cosmetic flaw. To get insurance coverage, your vein doctor must prove that the treatment is deemed medically necessary. This means the problem must cause physical symptoms that impact your ability to function.

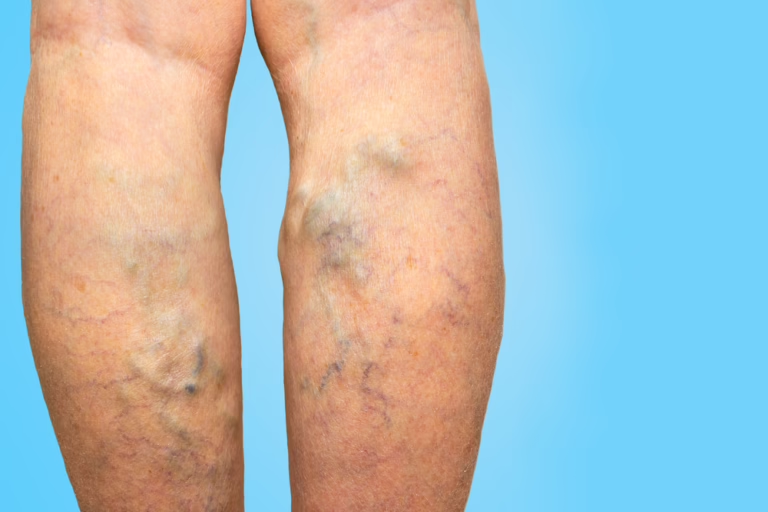

A varicose vein is considered a medical issue when it stems from underlying venous insufficiency. This condition occurs when the valves in your leg veins fail, allowing blood to flow backward and pool. This pooling leads to the bulging and twisting you see on the surface. If a varicose vein is asymptomatic and only bothers you because of its appearance, insurance plans will likely deny the claim. However, most patients seeking help do experience physical symptoms.

Your insurance provider will look for specific documentation in your medical records. They need to see that you have complained of symptoms like heaviness, aching, or cramping. The size of the varicose vein also matters in some policies, with larger veins often qualifying more easily for medical necessity status.

Key Takeaways

- Insurance covers treatments defined as medically necessary rather than cosmetic.

- Underlying venous insufficiency is the primary driver for coverage approval.

- Documentation of physical symptoms is required for a successful claim.

Symptoms That Qualify for Coverage

You must articulate your symptoms clearly during your consultation. A varicose vein that hurts is more likely to be covered than one that does not. Insurance companies look for specific keywords in the doctor’s notes. Common symptoms that help establish a case for coverage include distinct leg pain, throbbing, or a burning sensation directly over the vein.

Swelling in the lower legs and ankles is another major indicator. This suggests that the varicose vein is failing to transport blood efficiently against gravity. If you experience skin changes, such as darkening of the skin or inflammation (stasis dermatitis), this strengthens your case. In severe cases, venous disease can lead to open sores known as venous ulcers. These almost always qualify for immediate insurance coverage because they pose a significant health risk.

Another critical factor is a history of phlebitis or a blood clot. If a varicose vein has previously become inflamed or developed clots, it is a clear sign that the vein is a liability to your health. Your vein doctor will ask about these issues to build a comprehensive profile for your insurance plan.

The Diagnostic Process: Proving the Problem

Before any vein treatment begins, you must undergo a diagnostic ultrasound. This is the gold standard for evaluating varicose veins. The ultrasound allows the physician to see beneath the skin and measure blood flow. It confirms the presence of venous reflux, which is the backward flow of blood that causes the veins to bulge.

This scan maps out the anatomy of your legs. It identifies exactly which veins are failing and whether deep system issues like blood clots are present. Insurance providers require this objective data. They will not approve a varicose vein treatment based on visual inspection alone. The ultrasound report provides the measurements and reflux times that prove the varicose vein is mechanically broken.

Most vein clinics perform this ultrasound during your initial visit. It is a painless, non-invasive test that takes about 30 to 45 minutes. The results tell the doctor if you have chronic venous insufficiency, which is the medical diagnosis code usually required for insurance cover.

Pro Tip: Ask for a copy of your ultrasound report. Knowing your specific reflux measurements can help you understand why a treatment is medically necessary.

The Conservative Therapy Requirement

One hurdle many patients face is the requirement for “conservative therapy.” Before an insurance company agrees to pay for vein removal, they often want you to try non-surgical methods first. This typically involves wearing medical-grade compression stockings for a set period. The duration varies by policy but usually ranges from six weeks to three months.

The logic is that compression might alleviate the symptoms of a varicose vein enough that surgery isn’t needed. While stockings can manage symptoms, they do not fix the underlying broken valves. If you return to your doctor after the trial period and still have pain, the insurance cover for the procedure is usually granted.

You must document this period carefully. If you have already tried compression socks, elevation, and weight management on your own, tell your vein doctor. Sometimes, if your symptoms are severe or if you have skin ulcers, the insurance provider may waive this waiting period. However, for a standard varicose vein case, expect this step as part of the process.

Which Vein Treatments Are Covered?

Modern medicine offers several effective ways to treat varicose veins. Fortunately, most insurance plans cover the current standard of care. They have moved away from invasive vein stripping and now favor minimally invasive options. These procedures are done in the office and require little recovery time.

Endovenous Ablation

This is the most common vein treatment for the large saphenous veins that cause surface bulging. It involves using heat to close the diseased vein. Radiofrequency ablation and Endovenous Laser Treatment (EVLT) are the two main types. Both are widely accepted by insurance companies as the primary treatment medically indicated for chronic venous disease. The success rate is high, and the procedure is quick.

Microphlebectomy

While ablation handles the source of the problem deep in the leg, microphlebectomy handles the bulging varicose vein you can see. The doctor removes the varicose vein through tiny nicks in the skin. Insurance coverage for this is standard when done in conjunction with or after an ablation to relieve symptoms.

VenaSeal and Varithena

Newer technologies use medical adhesives (VenaSeal) or injectable foams (Varithena) to close the vein. Insurance cover varicose vein policies regarding these newer treatments can vary. Medicare and many private payers now cover them, but some policies may still consider them investigational. Always check with your specific plan.

Sclerotherapy for Medical Reasons

Sclerotherapy in Bristol involves injecting a solution into the vein to collapse it. While often used for cosmetic issues, it can be a covered vein treatment if the varicose vein is symptomatic and meets size criteria. Ultrasound-guided sclerotherapy is frequently covered for deeper veins that cannot be treated with ablation.

Spider Veins vs. Varicose Veins: The Coverage Gap

It is important to understand the difference between a varicose vein and a spider vein regarding payment. A spider vein is a small, thread-like vessel that appears red or purple on the skin’s surface. While they can be related to underlying vein disease, insurers almost always classify spider vein treatment as cosmetic.

You will likely pay out-of-pocket for spider vein procedures. Insurance cover varicose vein treatment mandates functional improvement. Since spider veins rarely cause significant pain or health risks like blood clots, they do not meet the threshold. However, if a spider vein bleeds spontaneously, insurance coverage might apply for the specific treatment to stop the bleeding.

Some patients have both issues. You might have a large varicose vein that is covered and clusters of spider veins that are not. In this scenario, the vein doctor will treat the medical issue using insurance, and you can choose to pay separately for the cosmetic spider vein removal if you wish.

Navigating Costs and Approvals

Even when insurance cover is approved, there are financial details to consider. You will still be responsible for your policy’s deductible and copayments. Vein treatments are surgery codes, so they often apply toward your deductible.

Most reputable clinics offer free insurance verification. This service allows the staff to contact your insurer directly to determine your specific benefits. They will tell you if you have met your deductible and what your estimated out-of-pocket cost will be for varicose vein removal. This transparency helps you plan your budget before scheduling any procedure.

If you do not have health insurance, or if your high deductible makes treatment difficult, many vein doctors offer payment plans. Do not let the sticker price deter you from an initial evaluation. The cost of ignoring vein disease can be higher in the long run if complications develop.

How to Get Your Vein Treatment Approved

- Schedule a Consultation

Visit a specialized vein clinic for an evaluation. Be honest and detailed about your symptoms, including pain, swelling, and how the varicose vein affects your daily life.

Tip: Bring a list of any previous treatments or conservative measures you have tried.

- Complete Diagnostic Testing

Undergo the ultrasound mapping. This provides the objective data regarding reflux and vein size that the insurance company requires for approval.

- Fulfill Conservative Therapy

Wear compression stockings as prescribed by your doctor. Document your compliance and report back if symptoms persist after the required period.

- Receive Authorization

Your clinic submits the data to your insurer. Once the authorization letter arrives, you can schedule your varicose vein treatment.

Choosing the Right Vein Clinic

Finding the right provider is just as important as understanding your insurance coverage. You want a vein specialist in Simsbury, not a general practitioner who does this on the side. Specialists understand the intricacies of billing codes and medical necessity requirements.

Experienced vein doctors have dedicated staff members who handle insurance verification daily. They know exactly what documentation each major insurer demands. This expertise reduces the likelihood of claim denials and surprise bills. When you book your appointment, ask specifically about their experience with your insurance plan.

A good clinic will also be honest about what is not covered. They should clearly separate the costs for medically necessary varicose vein treatments and elective spider vein procedures. Transparency is the mark of a professional medical practice.

Conclusion: Take the First Step

The question “does insurance cover varicose veins” has a positive answer for most people suffering from leg pain. You do not have to endure the discomfort of a heavy, throbbing varicose vein. Insurance companies recognize that vein treatments are vital for maintaining long-term health and mobility.

By understanding the difference between cosmetic spider veins and medical varicose veins, you can set realistic expectations. Prepare to demonstrate your symptoms and undergo the necessary diagnostic steps. With the right vein treatment medically authorized, you can restore your leg health and get back to an active life without financial worry. Reach out to a specialist today for free insurance checks and start your journey toward relief.